Who are the parties to the Loan?

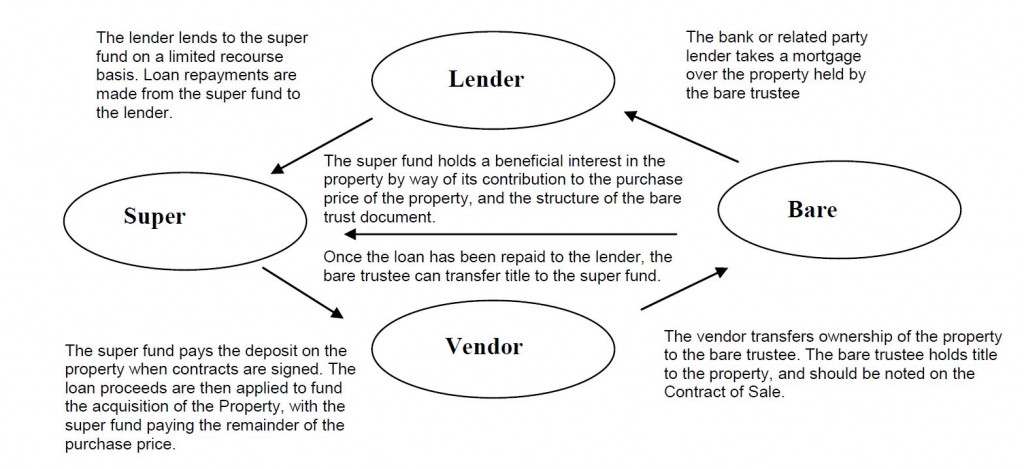

A Complying SMSF Loan has 4 parties – the Lender loaning the money to the Super Fund, the Super Fund itself, and the Vendor selling the property to the Super Fund and the Bare Trustee who will hold the Property on trust for the Super Fund. The role of each of these parties is outlined below:

What type of property can the Fund purchase via a Complying SMSF loan?

The property must be a property that the Super Fund could otherwise invest in if bought outright, and must comply with the in-house assets rule and sole purpose tests. So the Fund could purchase commercial or rural property from either a related party or non related party, or residential property from a non related party.

Who can Loan money to the Super Fund?

Both related parties and unrelated parties can lend money to the Super Fund via a SMSF Complying Loan.

What is the procedure to commence a SMSF Loan?

In order to ensure your Fund complies with the SIS Legislation and ATO requirements, it is important to set up your SMSF Complying Loan correctly.

Step 1 – Find the Property the Super Fund wishes to purchase

Step 2- Obtain pre approval of the Loan

Some clients may however enter into contracts before pre approval of the Loan is made. Clients should consider Step 5 at this point if they are signing the contract before pre approval of the loan.

Step 3 – Determine who will act as Trustee of the Custodian Trust / Bare Trust.

The vehicle that holds the property on trust for the Super Fund is called a ‘Custodian Trust / Bare Trust. The Bare Trust must have a Trustee, and it is the Bare Trustee that holds title to the property. The Trustee of the Bare Trust must be a separate legal entity from the Trustee of the Super Fund. We recommend you use a Company to act as Trustee of the Bare Trust.

Step 4 – Have the required documentation completed for the Fund to commence the borrowing.

This documentation is required for the Fund to comply with the SIS Legislation and the Australian Tax Office requirements. This documentation includes:

1. The Bare Trust and establishment of a company to act as Trustee of the Bare Trust

2. Updating the Super Fund Trust Deed (if required)

Step 5 – Sign the contract in the name of the Bare Trustee

NOTE: the contract of sale can be signed before pre approval of the Loan, however it is preferable for the contract to be signed after the Bare Trustee has been determined (or if a Company, established) so the Bare Trustee can be noted on the contract.

Step 6 – Settle the property with the Bare Trustee as the title holder.

Who signs the contract of sale?

The Trustee of the Bare Trust is the entity that holds the title to the property on trust for the Super Fund. Therefore, it is the Bare Trustee that should be noted as the purchaser of the property on the contract of sale, NOT the Super Fund or the Super Fund Trustee. Each state has different requirements regarding the manner in which the Bare Trustee is noted on the contract.

We recommend the purchaser on the contract be noted in the following manner:

[Bare Trustee Name] ATF [Bare Trust Name] ATF [Super Fund Trustee Name] ATF [Super Fund Name]

What about double stamp duty?

As long as the name of the purchaser on the contract of sale is correctly noted (see point above) and the Bare Trust Deed you are using is correctly prepared, there should not be stamp duty applicable when the Bare Trustee transfers title to the Super Fund.

What about personal guarantees?

Some of the major banks lending on SMSF Loans require personal guarantees, such as the NAB, Westpac and ANZ. Other banks, such as St George and Bendigo Bank do not require personal guarantees. The ATO has voiced its concern over SMSF Complying Loan arrangements where ‘a personal guarantee for the borrowing is given by a third party, particularly where the guarantee is given by a member or a related party of the Fund’. However there have not been any definitive rulings by the Tax Office regarding this matter.

Please note this is for information purposes only and does not constitute legal advice